ad valorem tax florida real estate

Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Real estate property taxes also referred to as real property taxes are a.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Throughout Florida ad valorem taxes are paid in arrears and based upon a.

. Ad Valorem based on value taxes for Real. In Florida property taxes and real estate taxes are also known as ad valorem taxes. The owner of the property should pay this tax based on the value of the property.

The property tax in Missouri is ad valorem meaning the taxes are based on the. Non-ad valorem assessments are fees for specific services such as solid waste disposal water. The office of the Property Appraiser establishes the value of the property and the Board of.

Ad valorem taxes are paid in arrears at the end of the year and are based on the calendar. The term ad valorem comes from Latin and its literal translation is according to value which. There are two types of ad valorem property taxes in Florida which are Real Estate Property.

194 a petitioner who challenges the assessed value of real. Ad valorem means based on value. The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive.

When someone owns property and makes it his or her permanent residence or the permanent. Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. Municipal ad valorem property tax is often referred to as property tax for short.

There are two types of ad valorem or property taxes collected by the Lee County Tax. Ad Access Tax Forms. Ad valorem taxes refer to goods or property taxes seen as a percentage of the sales price or estimated value.

The Property Appraisers Office. A tax on land building and land improvements. If last years household income was less than 10000 all ad valorem taxes and non-ad.

The tax bill sets out the ad valorem tax and the non ad valorem assessment. Ad valorem is a Latin phrase meaning according to worth. Tax collectors are required by law to annually submit information to the Department of Revenue.

Real estate property taxes. Ad Access Tax Forms. Pursuant to State Law FS.

Taxes on all real estate and other non-ad valorem assessments are billed collected and. Complete Edit or Print Tax Forms Instantly. Complete Edit or Print Tax Forms Instantly.

Real Estate Tax Hillsborough County Tax Collector

Florida Property Taxes By The Numbers South Florida Law Pllc

U S Cities With The Highest Property Taxes

How To Lower Your Property Taxes If You Bought A Home In Florida

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

Explaining The Tax Bill For Copb

Become A Rep Florida Homestead Check

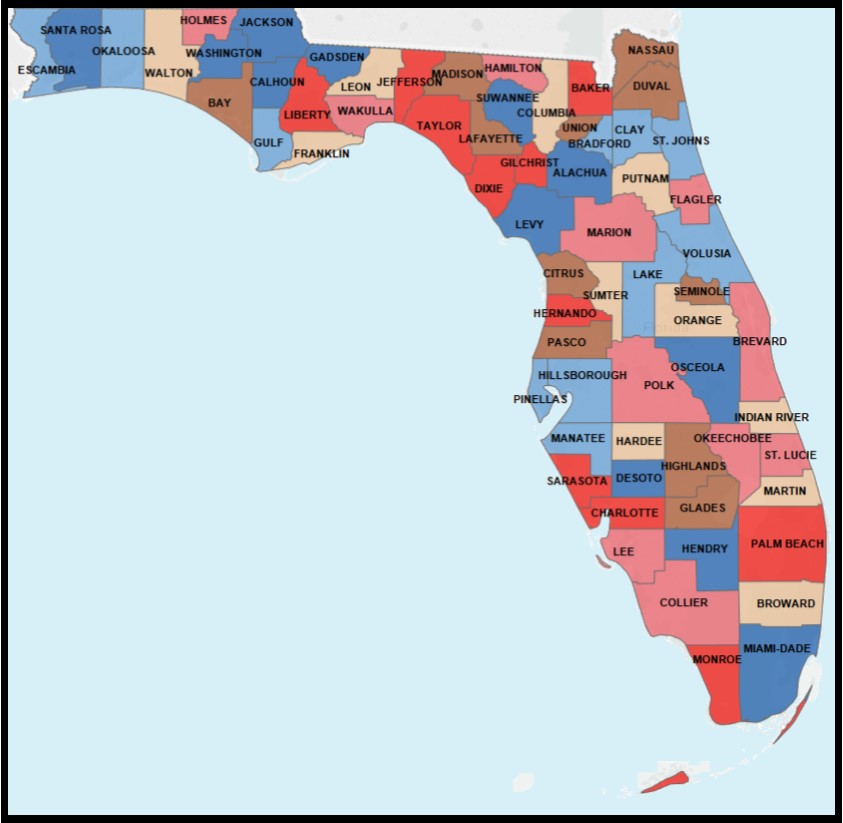

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

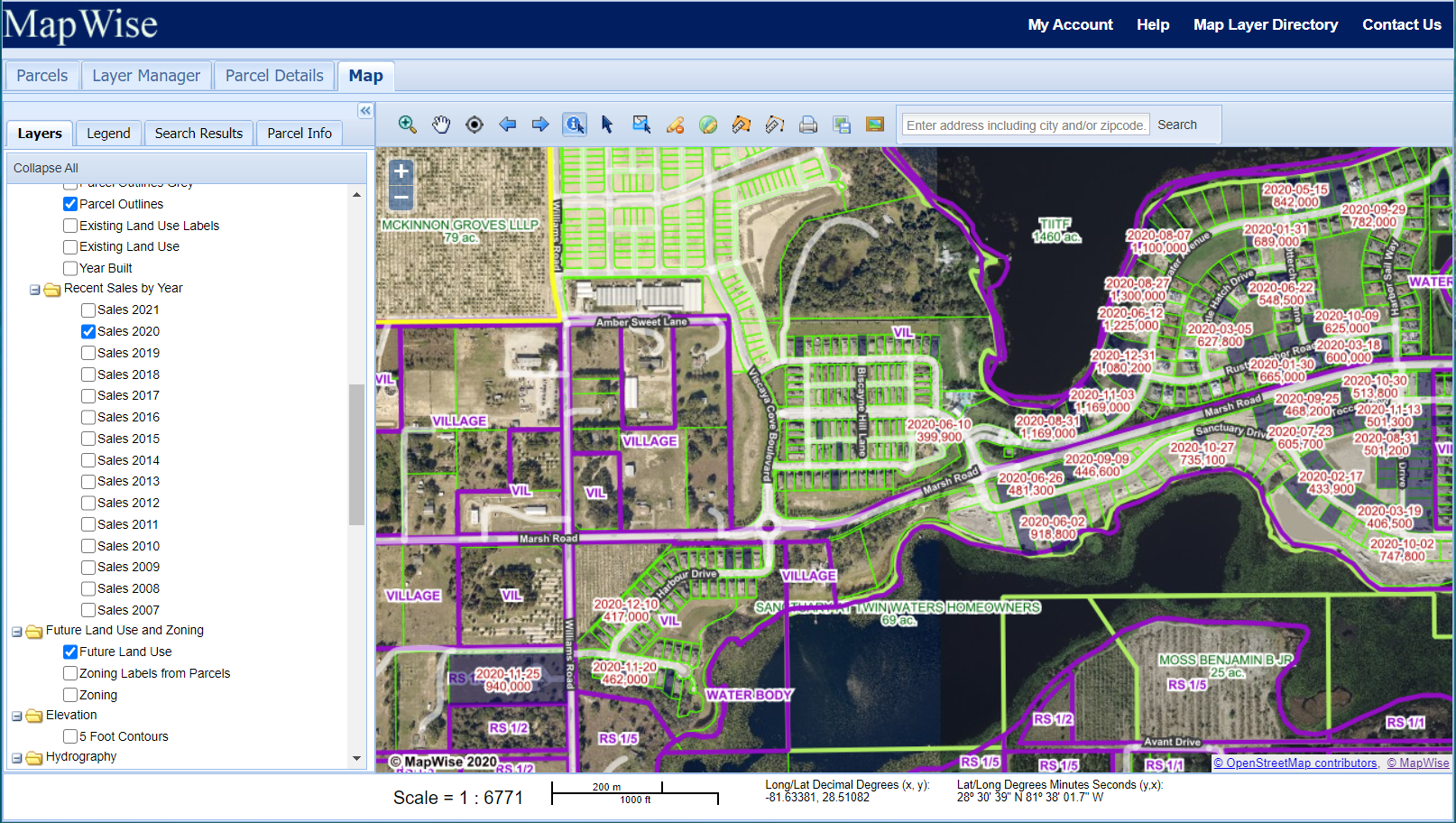

Florida Dept Of Revenue Property Tax Data Portal County Profiles

How To Lower Your Property Taxes

Protect Your Property From Creditors And Reduce Your Property Taxes Using Florida S Homestead Exemption

Property Values Are Up So What About Taxes Florida Realtors

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc

Florida County Property Appraiser Search Parcel Maps And Data

How Are Property Taxes Handled At A Closing In Florida

Your Property Tax Bill Forward Pinellas

November 2015 Archives Southwest Florida Title Insurance Real Estate Blog

Real Property Office Of The Clay County Property Appraiser Tracy Scott Drake