iowa capital gains tax real estate

Recent Tax Reduction and Action However 2018 legislation slightly reduced the states personal income and individual capital gains tax rate from 898. CPEC1031 of Iowa provides qualified intermediary services throughout the state of Iowa including.

When Does Capital Gains Tax Apply Taxact Blog

The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

. The capital gains deduction has a fairly brief history on. The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. The tax rate is about 15 for people filing jointly and incomes totalling less than.

The deduction you receive when selling your principal residence is as follows. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of household. Convert Your Home into a Short-Term Rental.

Capital GAINS Tax. Includes short and long-term Federal and State Capital. Unlike your primary residence you will likely face a capital gains tax if you sell for a profit.

Real estate capital gains tax deductions explained. Iowa has a unique state tax break for a limited set of capital gains. Capital Gains Tax on Sale of Property.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or. Stanley can claim the capital gain deduction on the 2014 Iowa return since he spent more than 100 hours per year in the material. The 15 rate applies to individual earners between 40401 and.

That goes doubly when you can avoid capital gains taxes on the first 250000 or 500000 in profits. Just like income tax youll pay a tiered tax rate on your capital gains. Taxes capital gains as income.

See Tax Case Study. 2022 federal capital gains tax rates. If you are single you can make up to.

The cutoff for not owing any capital gains tax is now 40400 for individuals and 80800 for married couples filing jointly. The capital gains deduction has a fairly brief history on the Iowa 1040 Individual Income Tax Form. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Toll Free 8773731031 Fax 8777797427. How are capital gains taxed in Iowa. Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two.

For sales made on or after January 1 1990 Iowa taxpayers could claim a 45 deduction. When a landowner dies the basis is automatically reset. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Certain sales of businesses or business real estate are excluded from Iowa taxation but only if they meet two. For example a single person with a total short-term capital gain of. The duplexes are sold in 2014 resulting in a capital gain.

Taxes capital gains as income and the rate reaches 853. Capital Gains Tax 2021 In Iowa with Ingredients and. The rate reaches 715 at maximum.

No one says you have to.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Iowa Governor Signs Tax Reform Into Law Center For Agricultural Law And Taxation

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/19430294/Screen_Shot_2019_12_04_at_1.44.54_PM.png)

Joe Biden S Tax Plan Explained Vox

State Taxation As It Applies To 1031 Exchanges

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

Capital Gains Tax In Kentucky What You Need To Know

How To Calculate Capital Gains Tax H R Block

How Capital Gains Affect Your Taxes H R Block

Real Estate Capital Gains Tax Rates In 2021 2022

Estimated Tax Penalties For Home Resales

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

What Are The New Capital Gains Rates For 2020

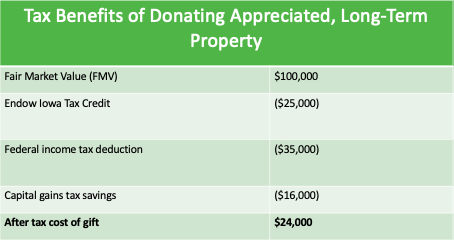

Final Four 4 Amazing Tax Breaks For Iowans On Charitable Gifts

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Understanding Capital Gains In Real Estate Clear Lake Ia Real Estate Homes Condos For Sale 641 231 1412

1031 Exchange Iowa Capital Gains Tax Rate 2022