arizona charitable tax credits 2020

Inflation-adjusted amounts for tax year 2022 are shown. Based on aggregated sales data for all tax year 2020 TurboTax products.

Arizona Charitable Tax Credit For Southern Arizona Home Facebook

See Form 1040 or 1040-SR line 30.

. The 1040 Quickfinder Handbook is your trusted source for quick reference to tax principles that apply when preparing individual income tax returnsIt covers all aspects of preparing a Form 1040 including tax law changes and IRS developments and is presented in a concise easy-to-use format. Information about Schedule H Form 990 Hospitals including recent updates related forms and instructions on how to file. To schedule an appointment please contact us at email protected.

Resident Personal Income Tax Return Arizona Form 140 DO NOT STAPLE ANY ITEMS TO THE RETURN. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Arizona Department of Revenue E-Services applications AZFSET Portal and 1099-G will be unavailable due to scheduled.

In addition the standard deduction may be increased by 25 percent of the charitable deductions the taxpayer would have been able to claim if the taxpayer had. 1 best-selling tax software. If you paid registration fees to a state that charges a tax based on the vehicles value you might be able to claim the deductible value-based sometimes ad valorem portion of your registration fee.

Arizona Form 140 Check box 82F if filing under extension 82F Your First Name and Middle Initial OR FISCAL YEAR BEGINNING M M D Last Name D 2 0 2 1 Spouses First Name and Middle Initial if box 4 or 6 checked Last Name Apt. E Standard deduction andor personal exemption is adjusted annually for inflation. 66F Your Social Security.

Qualified sick and family leave credits for certain self-employed individuals. Usually cash donations that you can deduct are limited to 60 of your adjusted gross income but that limit was temporarily eliminated for tax year 2021 returns just like it was for 2020. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Finally individual income tax rates hit the top tax bracket at an income level much higher than estate and trust tax rates. Arizona has a state income tax that ranges between 259 and 45 which is administered by the Arizona Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Arizona income tax forms. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Every state has its own way of calculating the registration fee on a vehicle and those calculations typically take several factors. F Arizonas standard deduction can be adjusted upward by an amount equal to 25 percent of the amount the taxpayer would have claimed in charitable deductions if the taxpayer had claimed itemized. Refundable child and dependent care tax credit 2021.

Earned Income Tax Credit EIC Child tax credits. Recovery rebate credit 2020 and 2021. Individual died in 2018.

1 online tax filing solution for self-employed. Based upon IRS Sole Proprietor. The 2020 standard deduction amounts are 12400 for single 18650 for head of household or 24800 for married filing joint.

The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. Any economic impact payments you received are advance payments of the recovery rebate credit. Certain itemized deductions including property tax qualified charitable contributions.

Complete and attach form SC-1040TC if you claim any tax credits. There are -784 days left until Tax Day on April 16th 2020. Beginning May 16 customers will be rerouted to the north entrance while building improvements are made.

Did Arizonas standard deduction increase for 2020. The Arizona income tax has four tax brackets with a maximum marginal income tax of 450 as of 2022. Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal.

Americas 1 tax preparation provider. Refundable child tax credit 2021. A professional athlete temporarily in the United States to compete in a charitable sports event.

Student Loan Interest deduction. Hospital organizations use Schedule H to provide information on the activities and policies of hospital facilities and other non-hospital health care facilities. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

Your trusted 1040 tax book for quick reference tax answers. In 2018 a single person does not hit the top tax bracket until their income exceeds 500000 versus 12500 for estates and trusts.

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Arizona Tax Credits Az Tax Credits 2020 Price Kong

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Arizona S 2020 Charitable Tax Credits Henry Horne

Qualified Charitable Organizations Az Tax Credit Funds

Give To Nac An Arizona Qualifying Charitable Organization Native American Connections

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Tax Credits Mesa United Way

Qualified Charitable Organizations Az Tax Credit Funds

Tax Credits For Donations To Area Groups And Schools Local News Paysonroundup Com

Arizona Charitable Tax Credits Parent Aid

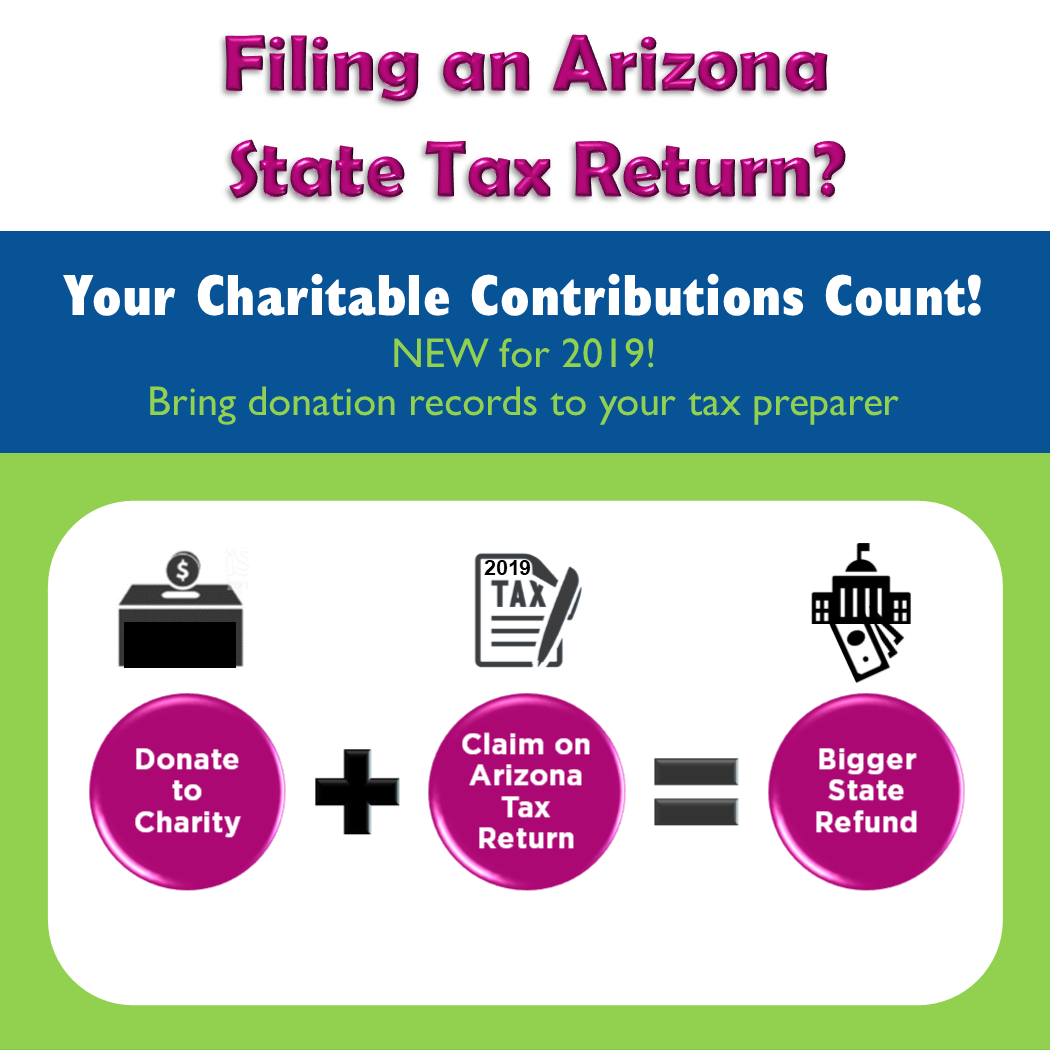

Charitable Contributions Count In Arizona Tempe Community Council

List Of 6 Arizona Tax Credits Christian Family Care

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Qualified Charitable Organizations Az Tax Credit Funds

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center